What is a standard lot in forex?

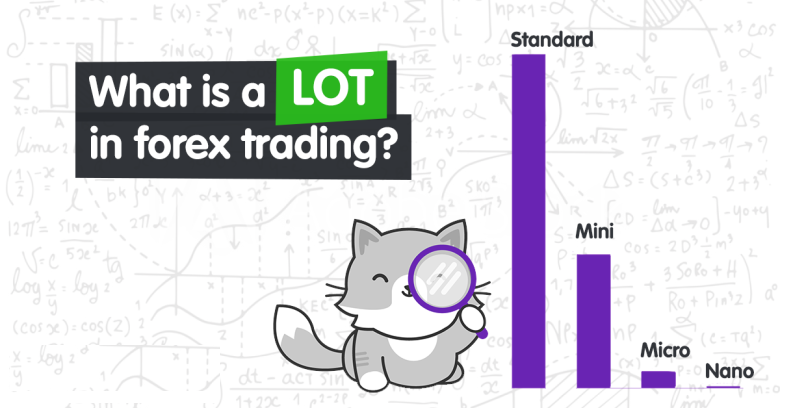

Forex traders have access to multiple lot sizes, offering increased flexibility and diversification. A standard lot represents 100,000 units of a base currency in the spot forex market while mini-lots are equivalent to 10,000 units and micro-lots represent 1,000 units. In addition to these more traditional options for sizing trades, investors can now fractionalize their positions by investing smaller amounts using non-standardized increments – giving them greater control over risk management strategies.

A standard lot is the equivalent of what used to be called a ‘round turn’ in the FX market. This was traditionally a transaction of 1 million USD worth of currency. Now that fractional lot sizes are available, the standard lot represents 100,000 units (1 pip = 0.0001). This makes it easier to calculate what each pip is worth relative to your position size and account balance. For example, if a trader is long 10 lots of EUR/USD, they have a position size of 1,000,000 EUR. Each pip movement in this position is worth 10 USD.

A Standard Lot Understanding

By using different lot sizes, traders can take advantage of various risk management strategies to better manage their exposure in the market. Standard lots offer more flexibility for larger transactions but also carry higher risks due to their large size. Mini-lots and micro-lots are attractive to beginner traders as they allow for smaller transactions and less risk. Ultimately, the lot size chosen should depend on the individual’s trading strategy and goals. Knowing what a standard lot is in Forex can provide you with the knowledge necessary to make informed trading decisions.

No matter what size a trader chooses to use, it is important for them to have an understanding of what a standard lot in Forex is and what risks are associated with it. Understanding the basics of lot sizing can help traders make more informed decisions when trading currencies in the spot forex market. With this knowledge, they can better manage their risk while still taking advantage of the potential profits available in the currency markets.

Which Lot Size is Best for Trading a Currency Pair?

Ultimately, what lot size a trader decides to use depends on their specific trading goals and strategy. For example, a scalper may choose to trade micro or nano lots while a swing trader might opt for a mini or even standard lots.

It’s important to remember that the risk level increases with the size of the lot; therefore, it is important to consider what your goals are and what type of risk you are willing to take on before selecting a lot size.

By understanding what a standard lot in Forex is, you can make more informed decisions about what lot size is best for you and your trading strategy. With the right knowledge and tools, you can confidently manage your risk and take advantage of the potential profits available in the currency markets.

Freddie Barlow is a genius forex trader. He has made a fortune in the markets, and his skills are sought by traders all over the world. Freddie's ability to read the market and anticipate changes has made him one of the most successful traders in history.